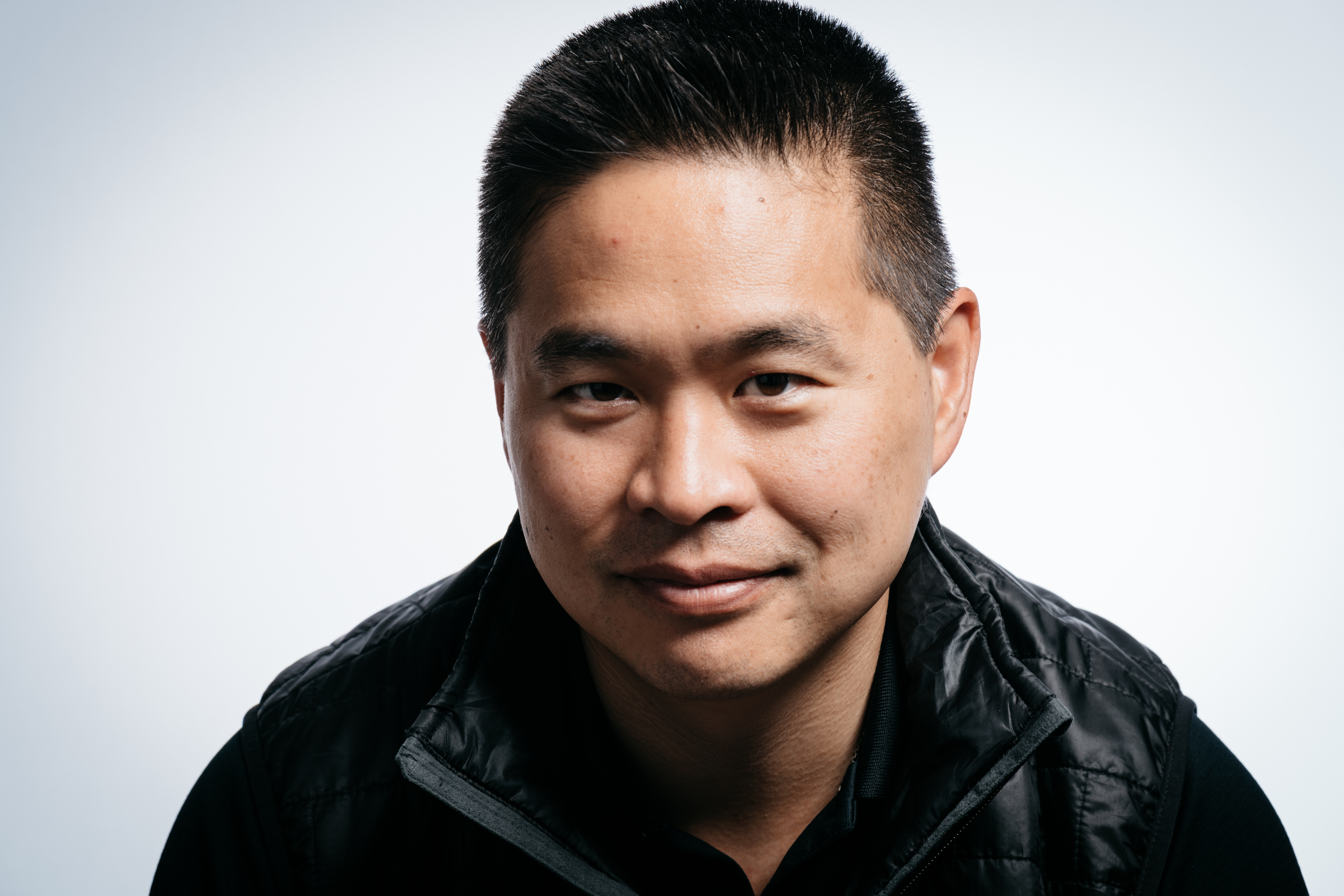

Brad Katsuyama (LinkedIn) wants you to be skeptical about the people who run the world’s money. The Stock Exchange is a complicated beast and one that is privy to manipulation and shortcuts. As Brad himself testified before the U.S. Senate finance committee in 2016 – things are not as simple as they seem, and certainly not as fair as they should be.

But Brad Katsuyama is seeking to change that. He is the CEO and co-founder of IEX, the Investors Exchange – a company whose goal it is to be a fairer stock trading venue than other exchanges.

“I would say that our stock exchange is set up a little bit differently, where we are trying to use technology to help everyday investors get the best possible execution, whereas other stock exchanges sell speed and data advantages to help the fastest traders.”

It’s not an easy task. In order to subvert decades-old financial institutions, you have to first understand them. And Brad knows his stuff. He started as an intern at the Royal Bank of Canada – converting paper files to digital ones. “It was not a glamorous job at all.” He then ended up meeting someone who worked in Toronto where he got a job at the trading desk. Brad believes his career started in Toronto, but he didn’t stay there long. “I moved to New York in 2002 when they had bought a bank from the Midwest and moved their trading operation to New York and essentially were looking for people to help start that desk. And at the time RBC was ranked number one in Canada, I think still is. And we were ranked 23rd in the United States. So for me, it was a no brainer. As a young person, kind of nothing to lose.” He was nervous, of course, but knew that the hesitation was probably a sign he was doing something right. “So part of [career growth] is being willing to challenge yourself in ways that are not comfortable.”

His time in the thick of things helped him understand how these financial institutions work, and – more importantly – where they don’t. “I would say it’s kind of like a horse race. Where certain people are betting on that horse race and they know the race has ended. And they’re betting against people who still think the race is happening. That’s really when the price of a stock changes and some people know that it’s just ticked lower and other people don’t, it lets people trade essentially at a stale price that should no longer exist.”

Therein lies the problem – one that Brad is trying to solve with the IEX. His years spent learning have paid off: it’s doing incredibly well. “So we just got approval at the end of last year to list companies and list interactive brokers… we went from being 3% of interactive brokers’ volume to 30%. The quote size, the bid and offer quotes has grown by 40% on average, since moving to IEX. The quote is also nearly twice as stable, which means it’s not jittering around, it’s not flickering. But the spread has widened. Meaning this artificially narrow spread of people trying to bid an offer that doesn’t exist. So a thicker more stable quote, to us, is a better indication of a healthy market.”

Brad’s rise to the top is no more simple than the inner workings of the stock exchange, but he was very clear about a couple of things that helped him on his journey to success. The first?

He had a boss who believed in him. When choosing to work for someone, Brad knew that signing with a boss who believed in his capabilities would make all the difference – and it did. In all arenas, he found that his boss would expect Brad to rise to the challenge. “Whether I had experience in that or not, when he saw something that needed to be fixed, he threw me at it. So partly I think it was a willingness to just get my hands dirty and solve problems.” This method might seem scary, but it exposed Brad to several different aspects of the business – not just the ones he knew. Being pushed outside his comfort zone was integral in his growth.

And the second?

He looked at the Long Game. When he was offered new positions, Brad didn’t just weigh the salary differences. He looked at how the position fit into his overall goals. “So any new job that popped up, I was the lowest risk person to offer that job to. Because I had no experience in that job, they knew I wasn’t going to ask for a guarantee. So it’s like, ‘Hey, here’s something else that you can do. Go do it.’” Having a boss willing to throw him into new positions and a mindset that allowed him to be open to those chances made all the difference. “So I think if you’re thinking long-term about your career development and you want to put yourself in the best position to get offered opportunities, make it the lowest risk possible for your company to do that.”

So what is next? Brad is a man whose job it is to predict financial landscapes, so you might not expect to find his outlook to be positive. But you’d be wrong.

“I love the optimism of entrepreneurs. Because it definitely makes you think things are possible, and it definitely, I think, gives me confidence that ten years from now the world will look a lot different than where we are now, in likely a better way.”

If Brad Katsuyama is betting on that, then we will too.

To hear more from this interview, click here.